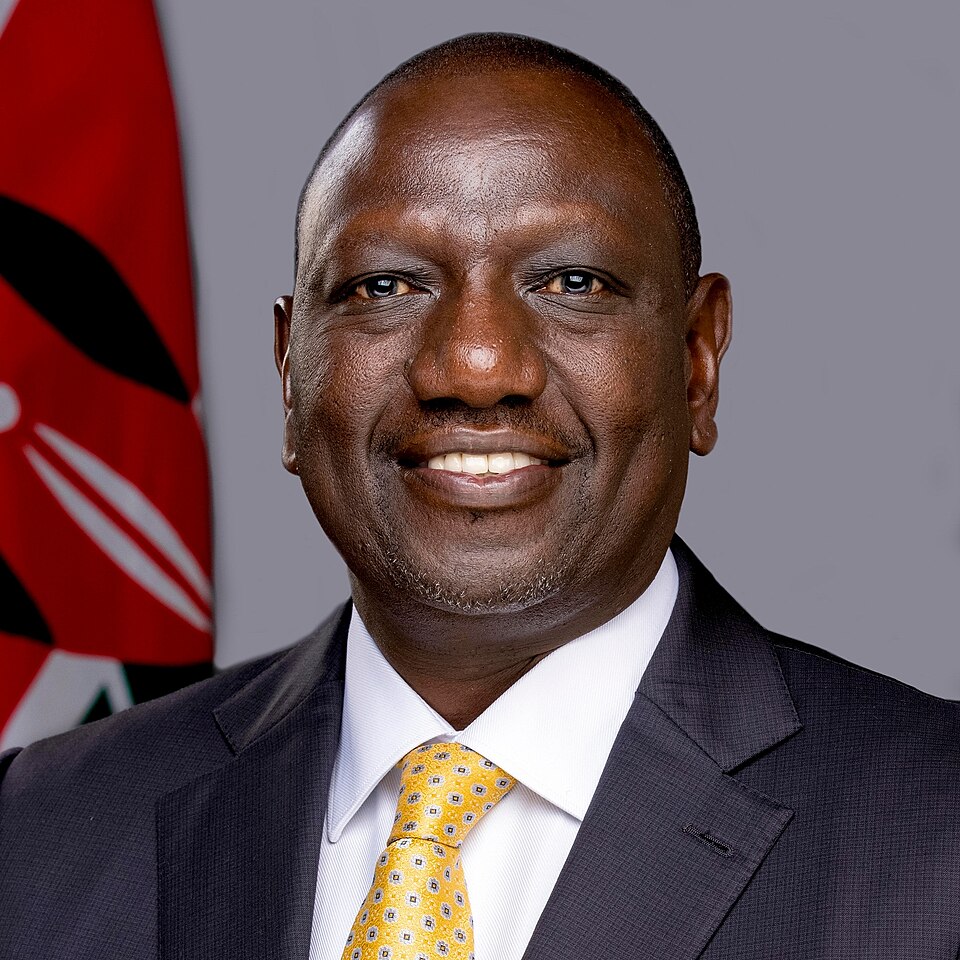

President William Ruto has commended the Central Bank of Kenya (CBK) for its decisive role in strengthening the Kenya shilling and amassing US dollar reserves now standing at KSh 1.3 trillion. Speaking during a recent address, Ruto credited the CBK’s monetary policy and market interventions for restoring confidence in the local currency.

Kenya Shilling Strengthens After Months of Pressure

The Kenya shilling has made a surprising recovery in recent months after a period of sustained depreciation. The CBK’s tight monetary policy, improved forex inflows, and reduced import demand have played a role in this rebound. Ruto noted that the stronger Kenya shilling signals positive momentum for the economy and eases pressure on inflation.

This improvement in the currency comes at a time when many emerging markets are still battling volatility in their exchange rates. For Kenya, the turnaround presents relief for both importers and ordinary citizens, as a firmer shilling helps reduce the cost of fuel, food, and other essential goods.

Foreign Reserves Hit KSh 1.3 Trillion Milestone

Equally noteworthy is the CBK’s success in building up the country’s foreign currency reserves. With reserves hitting the KSh 1.3 trillion mark (approximately $10 billion), Kenya now enjoys improved financial buffers against external shocks. These reserves serve as a safety net for the country’s economy and are a key metric watched by international investors and credit rating agencies.

President Ruto emphasized that the level of reserves meets and exceeds the recommended thresholds for import cover, a crucial indicator of economic health. He also highlighted that this financial positioning boosts Kenya’s credibility on the global stage.

What This Means for Kenyans

For the average Kenyan, the stronger shilling and growing reserves mean better economic resilience. Imports become cheaper, inflation is more contained, and investor confidence improves. Local businesses that rely on imported goods and services could see reduced costs, and the general public could benefit from price stability.

Ruto’s commendation of the CBK is more than political praise — it’s a reflection of tangible economic shifts. While challenges remain, such as debt servicing and global economic uncertainty, Kenya’s current monetary direction appears to be steering the country into calmer waters.